"Beats Flex-fragment design special edition" is now on sale on Apple's official website

11/03/2022

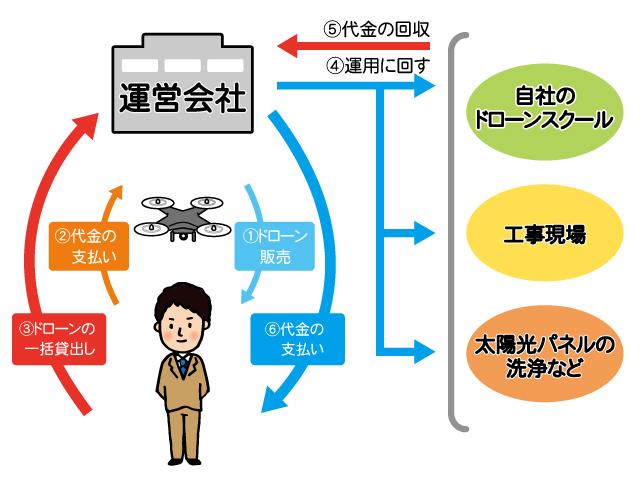

It seems that there is a "drone tax saving" in the world.According to Money Voice's article, this method purchases inexpensive drones and purchases many drones using a system that can be deprecated as a small depreciation asset if the acquisition amount is less than 300,000 yen.It is said that it will be a deduction for the fiscal year where the purchase cost has been obtained, and rental of drones will be rental income.Strictly speaking, it is not a tax saving but a tax payment, and it is a mechanism that can be postponed in the future while reducing the immediate tax amount.However, according to the article, it seems that as a result of the drone tax saving by a tax accountant corporation, etc., this method is pushed, and it seems that the authorities may be noticed by the 4 -year tax reform.(Money Voice).

Read Surad's comment | Japan | Business | Government | Money -related stories: JTB has reduced capital to 100 million yen.Tax burden by small and medium -sized businessAre you preparing something?September 22, 2020 Apple's Tim Cook CEO!Policy on the EU, Google, Apple, Facebook, and Amazon to impose special taxes on August 18, 2018, which are considered to be tax saving March 09, 2018

* This article is provided by Slad and distributed.

sponsor drink

Related keywords

Related article

sponsor drink

»See more social news